Are Offshore Trusts Legal? Separating Fact From Fiction

Are Offshore Trusts Legal? Separating Fact From Fiction

Blog Article

Exploring the Key Functions of an Offshore Count On for Wide Range Administration

Offshore trust funds have gotten interest as a tactical device for wide range monitoring. They use unique advantages such as possession protection, tax optimization, and improved privacy. These trust funds can be customized to fulfill specific monetary purposes, guarding possessions from prospective threats. Nevertheless, there are essential factors to consider to keep in mind. Understanding the complexities of offshore trusts might reveal more than simply benefits; it might uncover prospective difficulties that warrant careful idea

Comprehending Offshore Trusts: A Guide

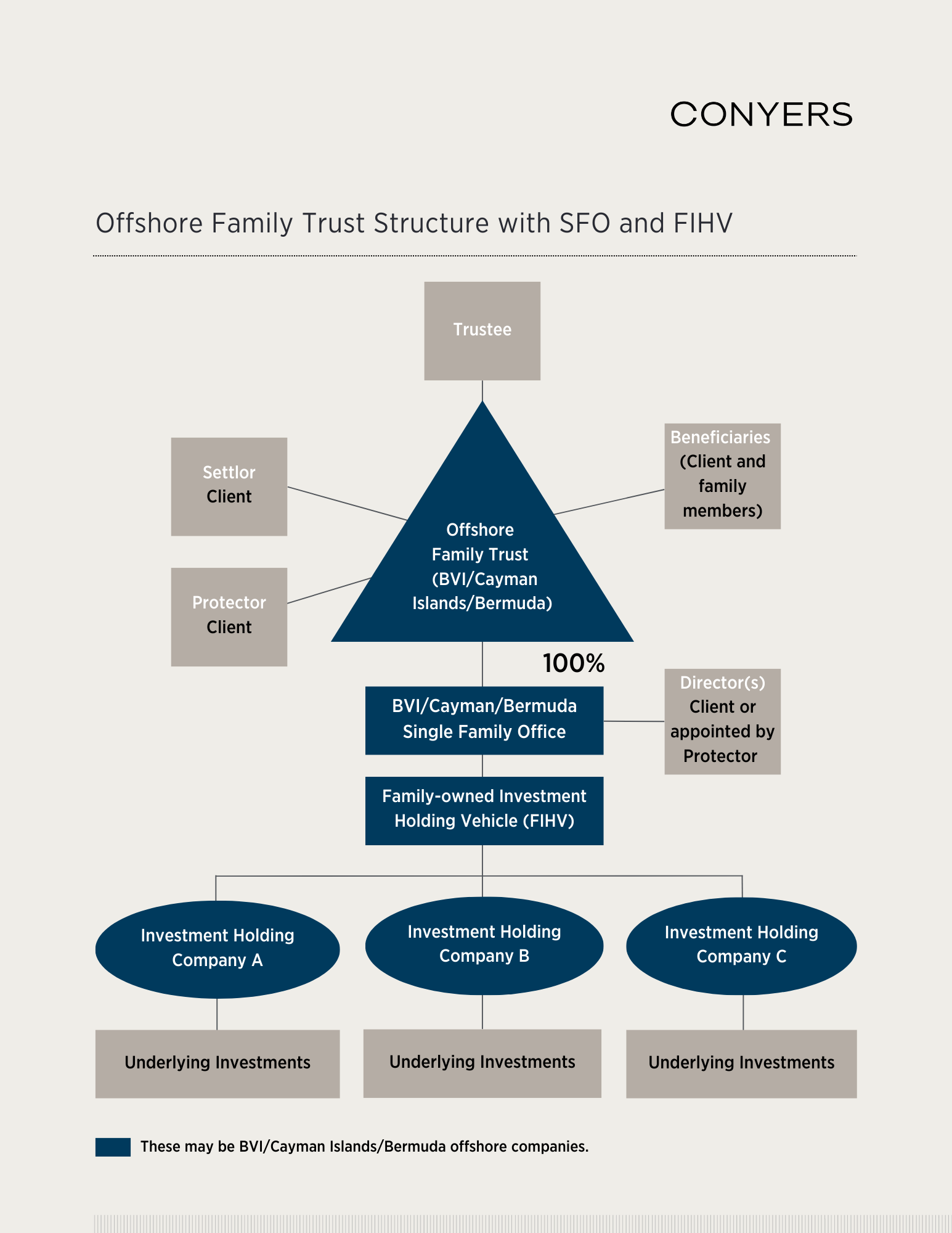

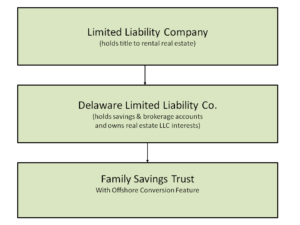

Although overseas depends on may appear facility, they serve as beneficial financial devices for individuals seeking to handle and secure their wide range. An offshore trust fund is a lawful plan where an individual, referred to as the settlor, transfers assets to a trustee in a foreign territory. This structure permits improved personal privacy, as the information of the depend on are not subject and commonly private to public analysis. Additionally, overseas trusts can offer flexibility pertaining to property management, as trustees can be picked based upon proficiency and administrative benefits. They can likewise be customized to meet certain economic objectives, such as estate planning or tax obligation optimization. Recognizing the lawful and tax effects of overseas trust funds is necessary, as regulations vary significantly across different countries. On the whole, these trust funds offer a calculated approach to wealth administration for those looking to navigate intricate financial landscapes while delighting in specific advantages that residential counts on may not supply.

Possession Security: Shielding Your Wide range

Property protection is a critical consideration for individuals seeking to guard their wide range from possible lawful claims, lenders, or unforeseen monetary troubles. Offshore depends on act as a calculated device for achieving this objective, giving a layer of protection that domestic assets might lack. By moving possessions right into an overseas trust, people can develop a lawful obstacle in between their riches and prospective complaintants, effectively securing these properties from claims or bankruptcy proceedings.The territory of the offshore trust fund often plays a vital function, as many nations use durable lawful structures that safeguard trust properties from external claims. In addition, the anonymity given by offshore trusts can even more deter financial institutions from pursuing claims. It is vital for people to comprehend the certain legislations governing property protection in their chosen territory, as this knowledge is essential for making the most of the performance of their wide range management strategies. Generally, offshore depends on represent a proactive strategy to maintaining wealth against unforeseeable economic challenges.

Tax Obligation Advantages: Navigating the Financial Landscape

Offshore trust funds use significant tax obligation benefits that can improve wealth monitoring strategies. They provide chances for tax obligation deferment, allowing possessions to expand without instant tax obligation effects. In addition, these counts on might offer inheritance tax advantages, additionally enhancing the financial legacy for recipients.

Tax Obligation Deferral Opportunities

Just how can individuals leverage offshore depend take full advantage of tax deferral opportunities? Offshore counts on provide a tactical opportunity for postponing tax obligations on earnings and funding gains. By placing possessions in an offshore trust, individuals can gain from territories with beneficial tax regimes, enabling prospective deferral of tax obligation liabilities up until circulations are made. This mechanism can be especially beneficial for high-income earners or investors with substantial resources gains. In addition, the revenue produced within the count on may not be subject to instant taxation, making it possible for riches to grow without the problem of yearly tax obligations. Steering with the intricacies of worldwide tax legislations, individuals can effectively utilize overseas depends on to improve their wealth management methods while decreasing tax direct exposure.

Estate Tax Perks

Privacy and Discretion: Keeping Your Matters Discreet

Maintaining privacy and confidentiality is crucial for individuals seeking to shield their riches and properties. Offshore counts on supply a robust framework for guarding individual information from public scrutiny. By developing such a trust, people can efficiently separate their individual events from their monetary interests, making certain that delicate information remain undisclosed.The legal structures governing offshore counts on frequently give strong personal privacy protections, making it challenging for exterior events to gain access to info without approval. This degree of privacy is especially interesting high-net-worth people worried regarding potential risks such as litigation or unwanted interest from creditors.Moreover, the distinct nature of offshore territories improves privacy, as these areas typically impose strict guidelines bordering the disclosure of trust fund details. Individuals can appreciate the peace of mind that comes with knowing their monetary methods are secured from public understanding, consequently maintaining their preferred level of discretion in riches monitoring.

Adaptability and Control: Tailoring Your Count On Structure

Offshore counts on supply considerable versatility and control, allowing individuals to tailor their depend on frameworks to satisfy specific monetary and personal goals. This flexibility makes it possible for settlors to select various elements such as the sort of properties held, circulation terms, and the visit of trustees. By selecting trustees that align with their goals and values, individuals can ensure that their wide range is managed according to their wishes.Additionally, offshore trust funds can be structured to accommodate changing conditions, such as fluctuations in economic demands or family dynamics. This means that beneficiaries can obtain distributions at defined intervals or under specific conditions, supplying more modification. The capability to change trust stipulations additionally ensures that the trust fund can develop in response to legal or tax changes, keeping its performance in time. Eventually, this level of adaptability equips people to produce a depend on that aligns seamlessly with their lasting riches management methods.

Possible Downsides: What to Consider

What difficulties might individuals encounter when considering an overseas count on for wealth administration? While offshore trusts provide numerous benefits, they also come with possible drawbacks that require careful consideration. One substantial worry is the price connected with developing and keeping such a trust fund, which can consist of legal charges, trustee fees, and ongoing management costs. In addition, people may come across intricate regulatory demands that vary by territory, possibly complicating conformity and bring about penalties if not adhered to properly. Offshore Trust.Moreover, there is an intrinsic danger of currency changes, which can impact the value of the assets kept in the trust. Depend on recipients might also deal with difficulties in accessing funds as a result of the administrative procedures included. Finally, public perception and potential scrutiny from tax authorities can create reputational dangers. These variables require detailed study and expert guidance prior to waging an overseas trust fund for riches monitoring

Trick Factors To Consider Prior To Developing an Offshore Trust

Prior to developing an offshore trust, individuals have to take into consideration several essential variables that can substantially influence their wide range monitoring technique. Lawful jurisdiction effects can influence the count on's performance and compliance, while taxes considerations may impact overall benefits. A comprehensive understanding of these elements is important for making informed choices relating to offshore trusts.

Legal Jurisdiction Effects

When considering the establishment of an offshore trust fund, the choice of legal jurisdiction plays an essential duty fit the count on's efficiency and safety. Various jurisdictions have varying regulations governing depends on, consisting of laws on possession defense, personal privacy, and compliance with international requirements. A jurisdiction with a durable legal framework can enhance the trust fund's legitimacy, while those with much less rigorous legislations may pose dangers. Furthermore, the online reputation of the picked jurisdiction can impact the trust fund's understanding amongst recipients and banks. It is essential to evaluate variables such as political stability, legal precedents, and the important site availability of experienced fiduciaries. Eventually, choosing the right territory is necessary for attaining the desired purposes of property security and riches monitoring.

Taxation Considerations and Conveniences

Taxation considerations considerably affect the decision to establish an overseas trust. Such trusts may supply significant tax benefits, including lowered revenue tax obligation responsibility and prospective inheritance tax benefits. In many territories, income produced within the count on can be exhausted at lower prices or not in all if the recipients are non-residents. Additionally, assets kept in an offshore trust might not undergo domestic click reference estate tax, facilitating riches preservation. It is important to navigate the complexities of global tax obligation regulations to assure conformity and stay clear of challenges, such as anti-avoidance laws. Subsequently, people need to consult tax obligation experts experienced in overseas frameworks to optimize benefits while sticking to relevant laws and laws.

Frequently Asked Concerns

How Do I Pick the Right Territory for My Offshore Count on?

Picking the appropriate territory for an offshore trust fund entails assessing factors such as legal stability, tax implications, regulative setting, and privacy regulations. Each jurisdiction provides distinctive advantages that can substantially affect wealth management strategies.

Can I Adjustment the Recipients of My Offshore Count On Later On?

The capacity to change recipients of an overseas trust depends on the trust fund's terms and administrative legislations. Typically, many offshore counts on allow modifications, but it is important to consult lawful recommendations to ensure compliance.

What Is the Minimum Quantity Needed to Establish an Offshore Count On?

The minimum amount required to develop an overseas trust differs considerably by jurisdiction and service provider. Generally, it ranges from $100,000 to $1 million, depending on the intricacy of the trust fund and connected fees.

Are There Any Type Of Legal Restrictions on Offshore Trust Fund Investments?

The legal limitations on offshore count on financial investments vary by territory. Generally, guidelines might restrict particular property types, impose coverage demands, or restrict purchases with specific countries, making certain compliance with international legislations and anti-money laundering procedures.

How Do I Liquify an Offshore Trust if Needed?

To dissolve an overseas trust, one have to follow the terms detailed in the count on act, ensuring compliance with appropriate laws. Legal suggestions is often recommended to browse possible intricacies and establish all responsibilities are fulfilled. By moving properties right into an overseas count on, individuals can produce a legal obstacle in between their riches and prospective complaintants, properly protecting these assets from legal actions or insolvency proceedings.The territory of the offshore trust often plays a crucial function, as numerous nations provide durable legal structures that safeguard trust properties from external insurance claims. By establishing such a trust, people can successfully divide their personal events from their financial rate of interests, making sure that delicate information remain undisclosed.The legal structures controling overseas depends on often provide solid privacy protections, making it tough for external events to gain access to details without permission. Offshore depends on provide significant versatility and control, permitting people to tailor their trust frameworks to fulfill certain monetary and personal goals. When thinking about the establishment of an offshore count on, the option of lawful jurisdiction plays an essential duty in forming news the trust's effectiveness and protection. The capability to transform beneficiaries of an offshore count on depends on the count on's terms and administrative laws.

Report this page